All Categories

Featured

Table of Contents

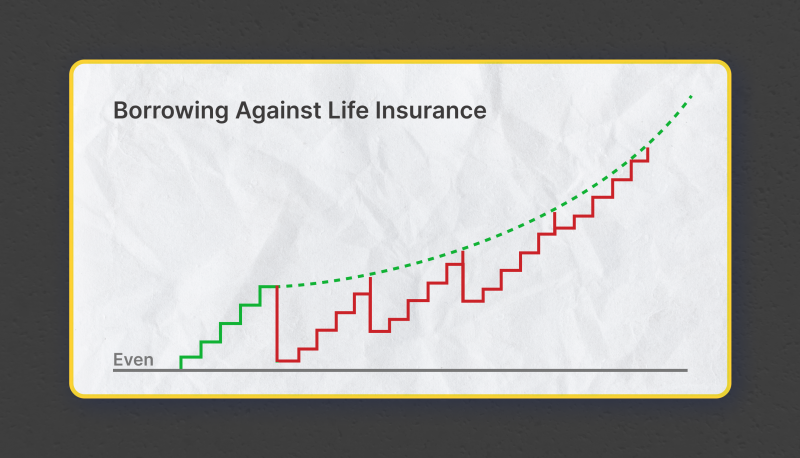

The repayments that would have or else mosted likely to a financial establishment are paid back to your individual pool that would have been utilized. The result? Even more money goes right into your system, and each buck is executing several tasks. Recapturing interest and reducing the tax concern is an excellent story. It obtains even much better.

This money can be made use of tax-free. The cash you make use of can be paid back at your leisure with no collection payment routine.

This is exactly how households pass on systems of wealth that allow the future generation to follow their dreams, begin organizations, and make the most of chances without shedding it all to estate and estate tax. Corporations and banking institutions utilize this method to create working pools of capital for their businesses.

How do I optimize my cash flow with Life Insurance Loans?

Walt Disney utilized this technique to begin his desire for developing a theme park for youngsters. We 'd enjoy to share a lot more instances. The concern is, what do desire? Peace of mind? Financial safety? An audio economic solution that does not count on a changing market? To have cash for emergency situations and possibilities? To have something to pass on to individuals you enjoy? Are you ready to find out more? Financial Preparation Has Failed.

Join one of our webinars, or go to an IBC bootcamp, all absolutely free. At no expense to you, we will certainly instruct you extra concerning how IBC works, and produce with you a strategy that works to address your problem. There is no responsibility at any point while doing so.

This is life. This is legacy (Leverage life insurance). Contact among our IBC Coaches right away so we can show you the power of IBC and entire life insurance today. ( 888) 439-0777.

It feels like the name of this idea modifications once a month. You might have heard it described as a perpetual wealth method, family members banking, or circle of wide range. No matter what name it's called, infinite banking is pitched as a secret way to construct riches that only abundant individuals understand about.

What is the long-term impact of Cash Flow Banking on my financial plan?

You, the policyholder, placed money into a whole life insurance plan through paying premiums and getting paid-up additions.

The entire principle of "financial on yourself" just works since you can "financial institution" on yourself by taking financings from the plan (the arrowhead in the graph above going from entire life insurance policy back to the insurance policy holder). There are two different kinds of lendings the insurance firm might offer, either direct acknowledgment or non-direct recognition.

One function called "wash loans" sets the rate of interest on lendings to the same rate as the dividend rate. This implies you can borrow from the plan without paying passion or obtaining interest on the amount you borrow. The draw of limitless financial is a returns rate of interest price and guaranteed minimum rate of return.

The downsides of limitless financial are typically neglected or not mentioned in all (much of the info offered about this principle is from insurance policy agents, which might be a little prejudiced). Just the cash money worth is expanding at the returns rate. You additionally need to spend for the expense of insurance policy, costs, and expenditures.

How long does it take to see returns from Leverage Life Insurance?

Every long-term life insurance coverage plan is various, however it's clear a person's general return on every buck invested on an insurance policy product might not be anywhere close to the dividend rate for the policy.

To offer a very standard and theoretical example, let's think a person is able to earn 3%, on average, for every buck they spend on an "limitless banking" insurance product (after all costs and fees). If we think those bucks would be subject to 50% in taxes complete if not in the insurance coverage product, the tax-adjusted price of return might be 4.5%.

Infinite Banking is not just for entrepreneurs—it’s a key strategy for creating generational wealth.

Parents can use Infinite Banking to pay for major family expenses, all while ensuring long-term wealth growth.

Legacy planning experts assist in structuring Infinite Banking policies - what is infinite banking. Schedule a consultation today to set up a tax-free financial system

We think greater than average returns overall life item and an extremely high tax rate on bucks not take into the plan (which makes the insurance policy item look much better). The reality for several individuals may be even worse. This fades in contrast to the long-lasting return of the S&P 500 of over 10%.

How can Self-banking System reduce my reliance on banks?

Boundless banking is a terrific product for agents that sell insurance policy, however may not be ideal when compared to the less expensive choices (without any sales individuals earning fat payments). Right here's a malfunction of some of the other supposed benefits of infinite financial and why they may not be all they're gone crazy to be.

At the end of the day you are getting an insurance coverage product. We love the security that insurance supplies, which can be gotten a lot less expensively from an affordable term life insurance policy policy. Unsettled finances from the policy might also reduce your survivor benefit, lessening an additional level of defense in the policy.

The idea just works when you not just pay the considerable premiums, but use added cash to acquire paid-up enhancements. The possibility cost of all of those dollars is tremendous extremely so when you can instead be spending in a Roth Individual Retirement Account, HSA, or 401(k). Also when contrasted to a taxed investment account or perhaps a cost savings account, boundless banking may not use similar returns (contrasted to spending) and comparable liquidity, accessibility, and low/no charge structure (contrasted to a high-yield interest-bearing accounts).

Several people have never listened to of Infinite Banking. Infinite Banking is a means to manage your money in which you produce an individual financial institution that functions simply like a regular bank. What does that indicate?

How does Financial Leverage With Infinite Banking compare to traditional investment strategies?

Merely placed, you're doing the banking, but instead of depending on the traditional bank, you have your own system and full control.

Infinite Financial isn't called that method without a reasonwe have boundless ways of executing this procedure right into our lives in order to genuinely possess our lifestyle. So, in today's short article, we'll show you 4 various methods to make use of Infinite Financial in company. We'll go over 6 means you can utilize Infinite Financial personally.

Latest Posts

How To Train Yourself To Financial Freedom In 5 Steps

Infinite Banking Insurance Policy

Infinite Banking Reviews